Wake County Property Tax Rate 2024 History Facts – Home values across Wake County have shot up in the past four years, according to newly released results of the county’s 2024 revaluation. Residential properties rose an average of 53% in tax value . You can contact the tax administration to send a duplicate if you misplaced it. The mailing address is: Wake County Tax Administration Attention: 2024 Real Estate Revaluation PO Box 2331 .

Wake County Property Tax Rate 2024 History Facts

Source : www.facebook.com

iMAPS Information | Wake County Government

Source : www.wake.gov

Expert on how to appeal rising property values in Wake County

Source : www.cbs17.com

Historic Yates Mill Visitor Information | Wake County Government

Source : www.wake.gov

Wake County unanimously passes $1.8 billion budget, property tax

Source : www.wral.com

Expert on how to appeal rising property values in Wake County

Source : www.cbs17.com

Who pays for NC schools? State underfunding could shift the burden

Source : www.wunc.org

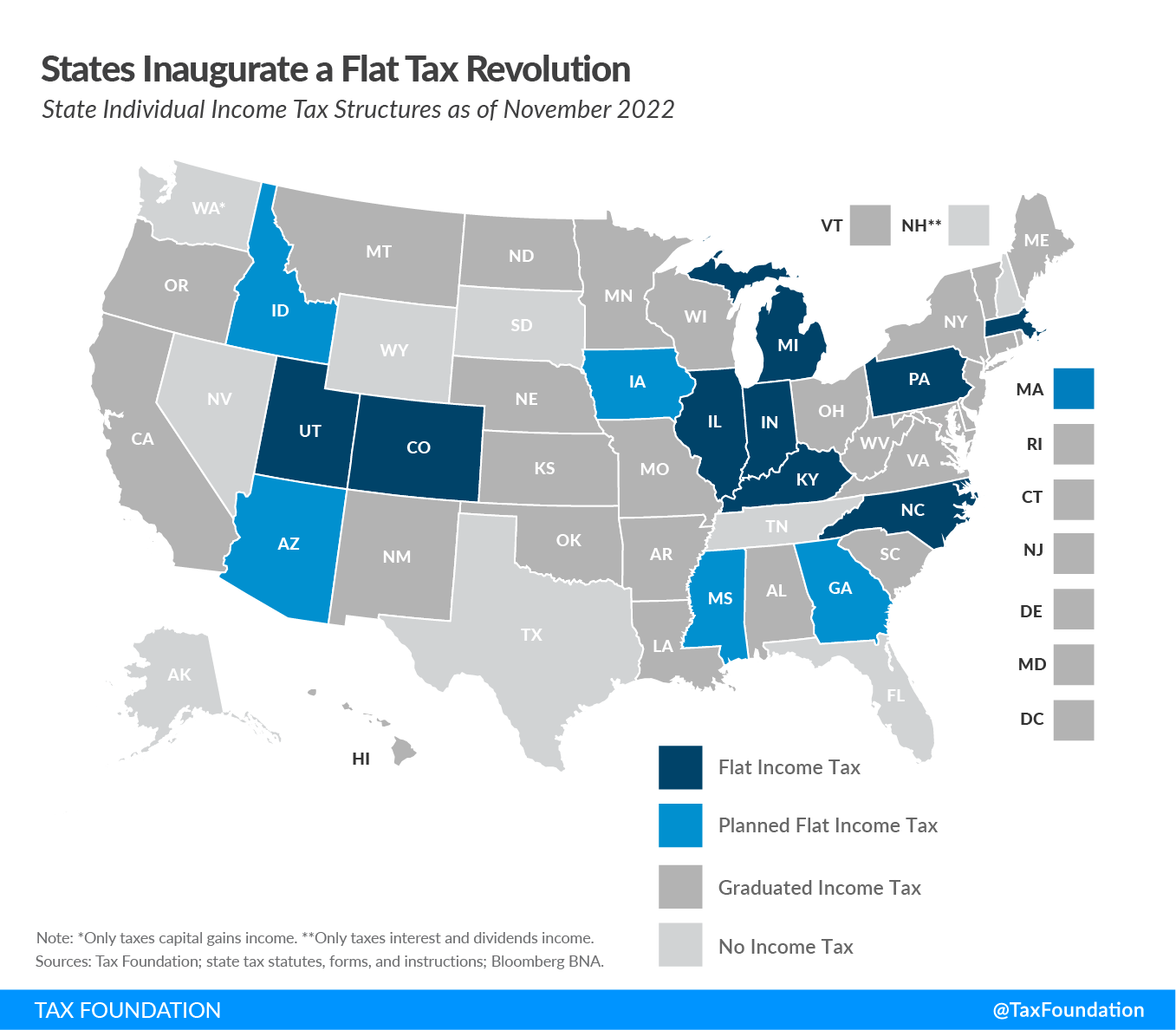

Flat Tax Revolution: State Income Tax Reform | Tax Foundation

Source : taxfoundation.org

Expert on how to appeal rising property values in Wake County

Source : www.cbs17.com

Wake County homeowners brace for property tax adjustments: What to

Source : www.wral.com

Wake County Property Tax Rate 2024 History Facts Raleigh Downtown | Raleigh NC: New assessments are being sent out this week, and some people are reporting their home value soared as high as 80%. . The revaluation comes at a time when the cost of homeownership is higher than we saw during the pandemic – with mortgage rates hovering around 7 percent. .